jersey city property tax abatement

Office building store or any building shall display the street number pursuant to City Code 108-5. Left click on Records Search.

A Less Taxing Lifestyle Awaits In Port Imperial At Nine On The Hudson Jersey Digs

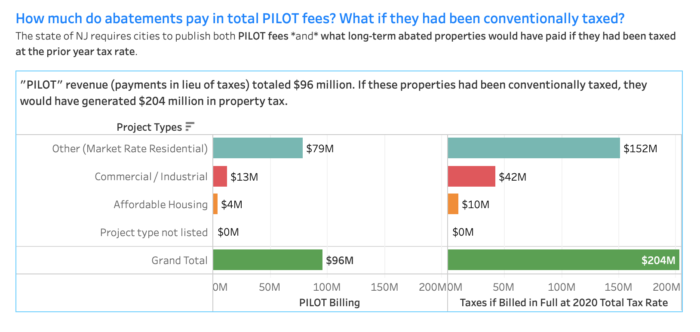

While schools receive a portion of regular property tax they do not receive any of the PILOT fees.

. Programs you may be eligible for include. When I bought in 2020 it might pass the abatement period. TO VIEW PROPERTY TAX ASSESSMENTS.

Annual Year Income Statement for qualifying Seniors PD 65 Note. Posted on 12012020. Automatic Fire Suppression System Property Tax Exemption.

Jersey city property tax abatement Saturday March 19 2022 Edit Jersey City Public School which educates about 30000 students at its peak received 4187 million in state aid for the 2016-2017 school year but it will have seen more than 2336 million. It has provided the Purchaser with true correct and complete copies of the Financial Agreement and all other. APPLICATION FOR REAL PROPERTY TAX ABATEMENT FOR.

City property tax aka the city levy This is the amount of property tax required to fund the city budget. These programs are managed by your municipality. By Mail - Check or money order to.

To determine how the new tax abatement policy may impact your project it is advisable to consult with an experienced New Jersey attorney. Tax Abatement for Jersey City Property. Fulop announced today the city is moving forward with the termination of a tax abatement for 4 of the 6 buildings within The Beacon Community located at 20 Beacon Way after the developer Baldwin Asset Associates Urban Renewal Company Baldwin defaulted on its 2005 financial.

Eduardo CToloza CTA City Assessor. Instructions on How to Appeal Your Property Value. Abatements are a structural portion of Jersey Citys budget ie.

2021 second half service charge liability payment in lieu of taxes. Household Family and Per Capita Income and Individuals and Families Below Poverty Level by City. If your condo qualifies for tax abatement in jersey city do you pay the property taxes in entirety and then get a refund or do you pay the lower.

Five Year Exemption and Abatement. 2 of annual City service charge. Environmental Opportunity Zone Property Tax Exemption.

294 Griffith St 2 Jersey City NJ 07307. Press question mark to learn the rest of the keyboard shortcuts. Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street.

Taxes are levied pursuant to chapter 4 of Title 54 of the. Property Tax Abatement in Ohio. Buy and sell with Zillow 360.

10 annual gross revenues. The city of Cleveland temporarily eliminates 100 of the increase in real estate tax of a property when the homeowners remodel or convert it into a two-family or multifamily home. Jersey City Home values.

Under the Jersey City School Funding Action Plan Mayor Fulop and Councilman Yun outline a detailed agenda to avoid massive tax increases while providing 250 million in net gain directly into the citys public schools budget over the next 3 years to provide a stable stream of revenue for the BOE. Bundle buying selling. New Jersey authorized its municipalities to provide homeowners and property developers a 5-year tax abatement through the NJSA.

This the most direct impact that abatements have on our schools but more is explained below. Senior Freeze Property Tax Reimbursement. JERSEY CITY Mayor Steven M.

Jersey City NJ 07302 Tel. Historic Site Property Tax Exemption. Every taxpayer pays a small fraction of the total levy that fraction is your city property tax expense.

The four New Jersey cities with the lowest median family income based on the 2009 American Community Survey from the US Census Table 708. The revised policies and procedures apply to future long term PILOTs and related financial agreements. This condo was 1st sale date was 2011 it might have a abatement in the property tax for a while.

Press J to jump to the feed. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST. The two forms must be filled out yearly on or before March 1st.

New Jersey offers several Property Tax abatements and exemptions. City of Jersey City. 5227H-60 et seq and shall include the entire area withi n.

Jersey City abatements have historically sent 95 of the PILOT fees to the city 5 to the county and 0 to the schools. In the past year Ive also written about tax appeals and I also served on a team of Jersey City Together volunteers in 2017 that helped over 30 residents save over 40000 in tax expense through successful appeals. A municipality which contains a Tourism District as established pursuant to section 5 of.

On June 5th I. However had the real estate been taxed based on 2020 rates it would have paid over 204 million in property tax made up of 93 million in city tax 55 million in school tax and 56 million in county tax based on. APPLICATION FOR REAL PROPERTY TAX ABATEMENT FOR RESIDENTIAL PROPERTY IN AN URBAN ENTERPRISE ZONE CHAPTER 207 PUBLIC LAWS 1989 as amended.

Box 2025 Jersey City NJ 07303. 5 of annual City service charge. Programs you may be eligible for include.

For the past 4 years Ive been researching and writing about property taxes and revaluation among other topics on CivicParent. We have always said that we would do our. 5 Year Tax Abatement - Jersey City NJ Real Estate.

The City Council will introduce an ordinance revoking a 20-year tax abatement on a five-story residential building under construction at 305 West Side Ave. In Person - The Tax Collectors office is open 830 am. ACH Direct Debit Application.

Find a sellers agent. Pursuant to the New Jersey Urban Enterprise Zones Act PL1983 c. Online Inquiry Payment.

Jersey City Mayor Steven Fulop has announced that the city will move forward with the termination of a tax abatement for four of the six buildings within The Beacon Community at 20 Beacon Way. I received the letter from Jersey City 2021 abatement service charge liability. ACH Direct Debits do not incur a fee.

City of Jersey City PO. These 160 abatements projects paid a total 96 million in PILOT fees which primarily funds the city and secondarily the county. They are baked into the budget each year in.

Jersey City Abatement Policy Civic Parent

New Jersey S Tax Exemption And Abatement Laws Onhike

Luxury Ads에 있는 化圣 高님의 핀 부동산 포스터

5 Year Tax Abatement Jersey City Real Estate 16 Homes For Sale Zillow

Jersey City Abatement Policy Civic Parent

Jersey City Abatement Policy Civic Parent

Jersey City Abatements Dashboard For Taxpayer Advocacy Civic Parent

A New Study Revives The Debate Over Property Tax Abatements

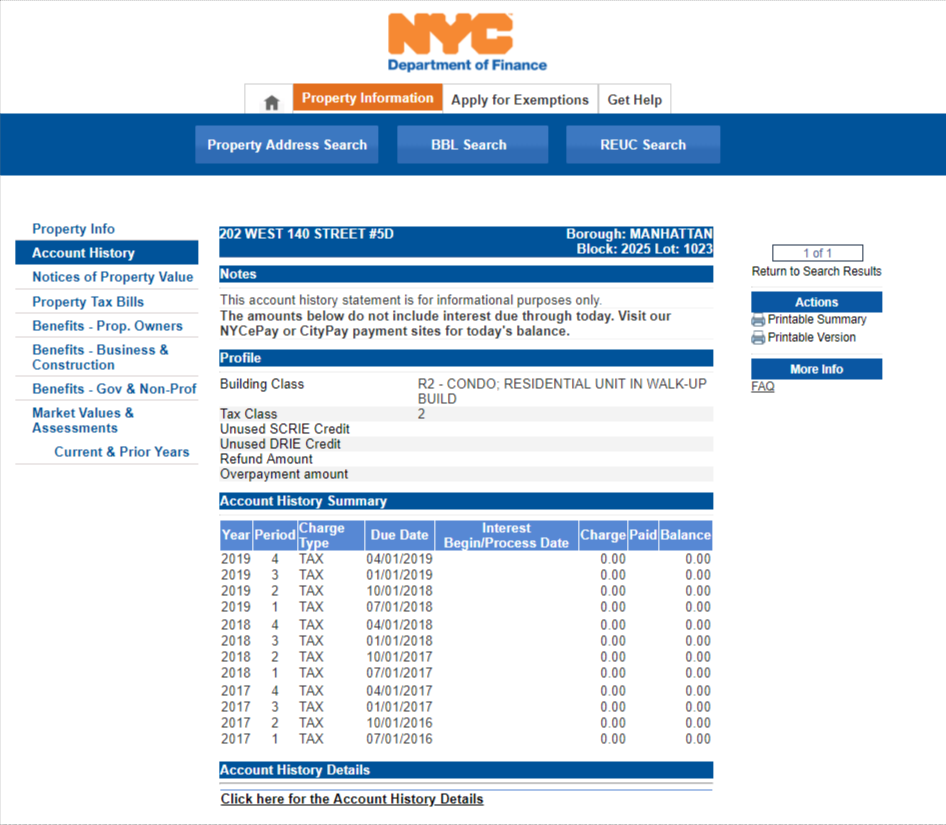

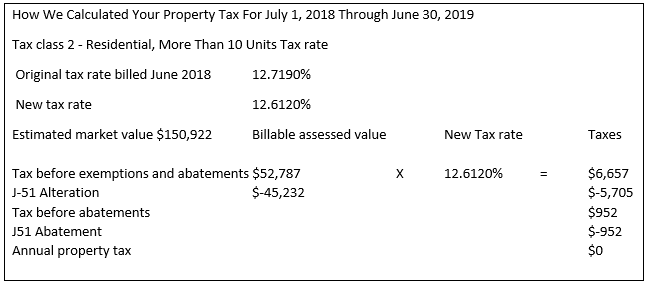

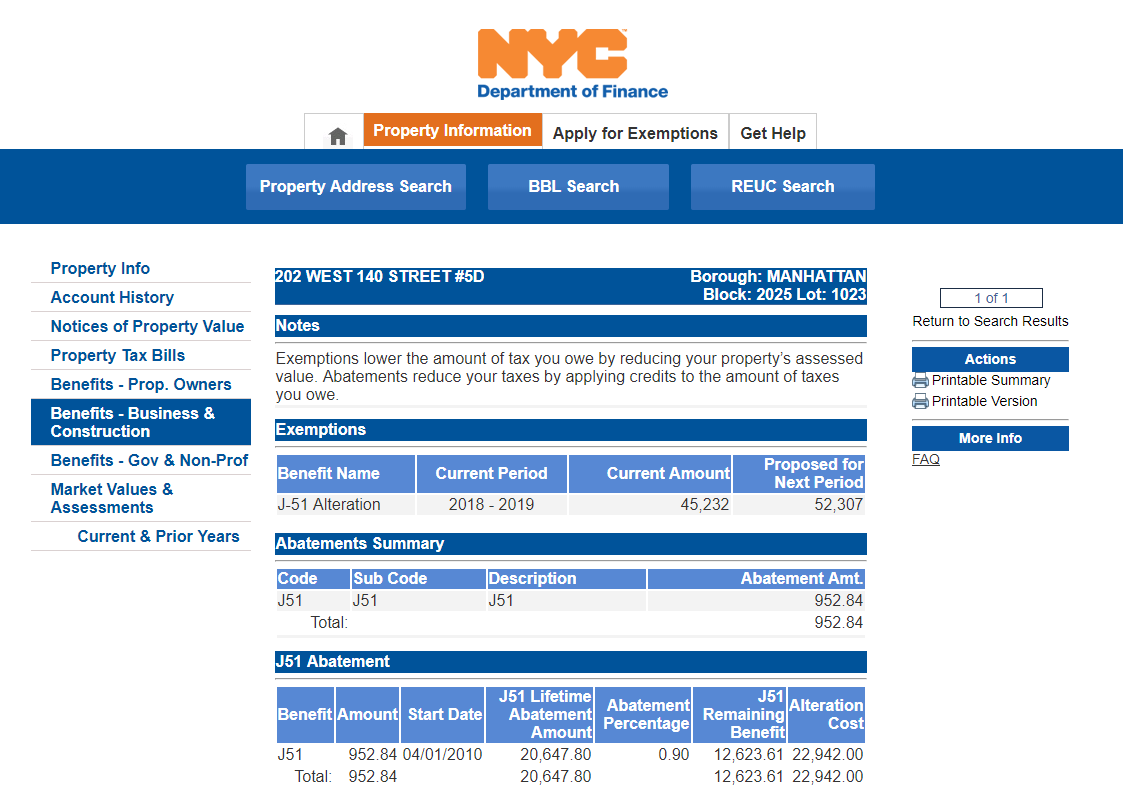

Buying An Apartment With A J 51 Tax Abatement Hauseit

Tax Abatement Series Civic Parent

Buying An Apartment With A J 51 Tax Abatement Hauseit

Buying An Apartment With A J 51 Tax Abatement Hauseit

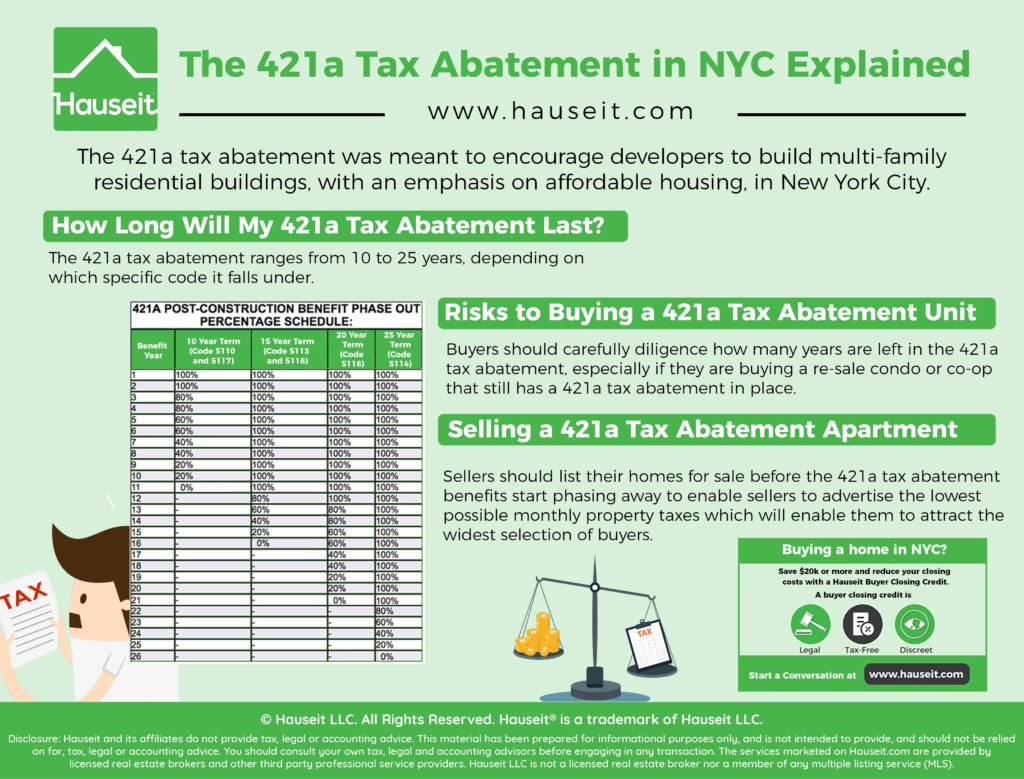

The 421a Tax Abatement In Nyc Explained Hauseit

Buying An Apartment With A J 51 Tax Abatement Hauseit

Jersey City To Terminate Tax Abatement With The Beacon Hudson Reporter

A New Study Revives The Debate Over Property Tax Abatements

Abatements 801 We Need Better Abatement Disclosures In Nj To Show Impact On Public Schools Civic Parent

What Is The 421g Tax Abatement In Nyc Hauseit

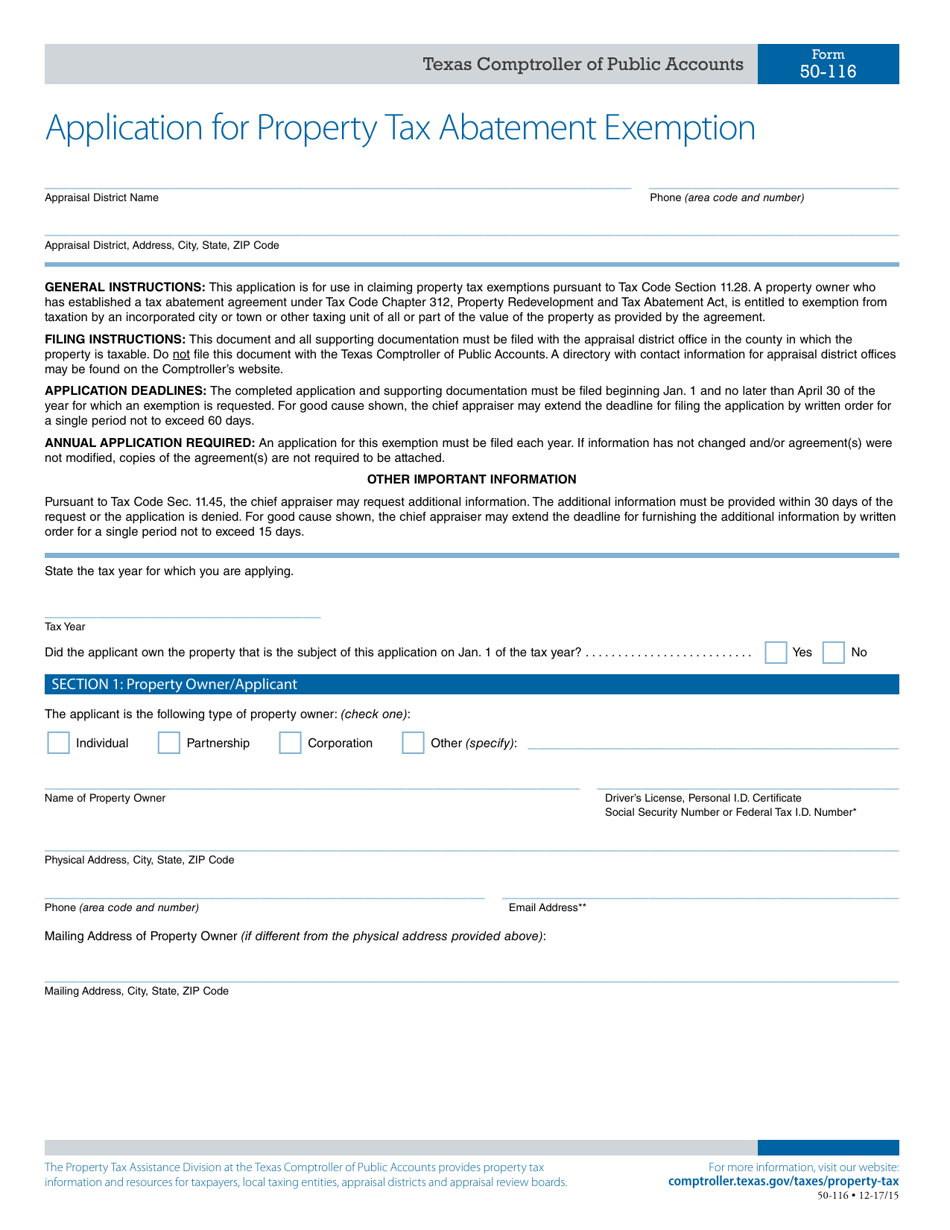

Form 50 116 Download Fillable Pdf Or Fill Online Application For Property Tax Abatement Exemption Texas Templateroller